4 / 9 / 2025 THURSDAYS

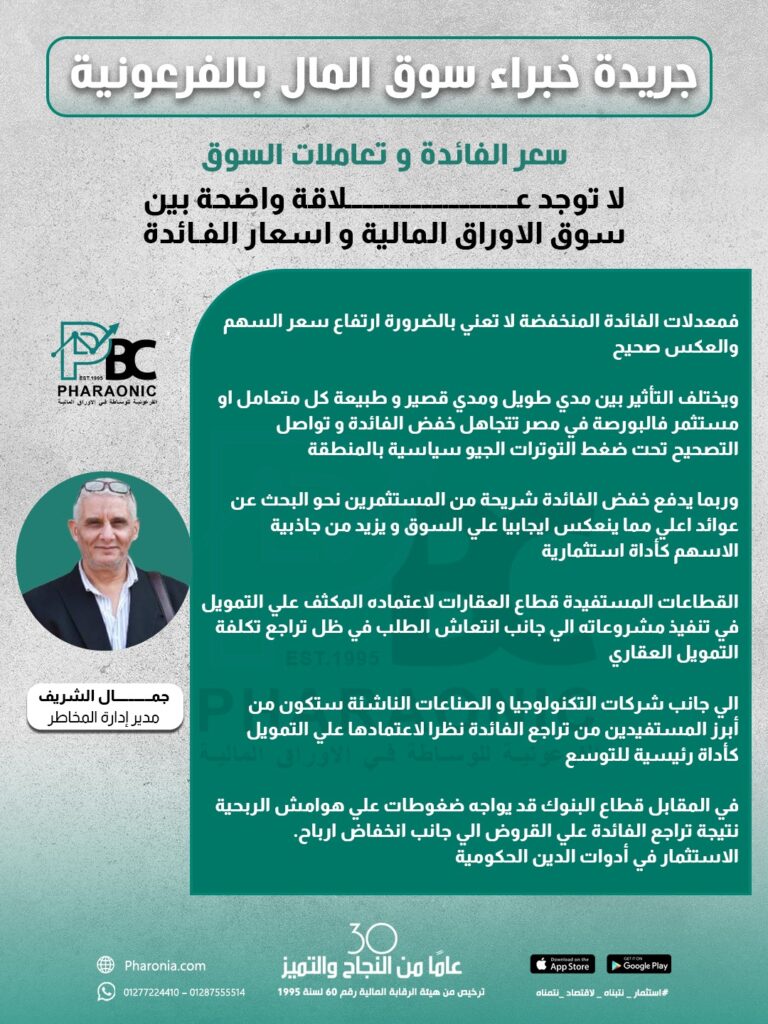

Interest rate and market transactions

There is no clear relationship between the stock market and interest rates.

- Low interest rates do not necessarily mean higher stock prices, and vice versa.

- The impact varies between the long and short term, depending on the nature of each trader or investor. The Egyptian stock market is ignoring the interest rate cut and continuing to correct under the pressure of geopolitical tensions in the region.

- The interest rate cut may push a segment of investors to seek higher returns, which will have a positive impact on the market and increase the attractiveness of stocks as an investment vehicle.

- Sectors that will benefit include the real estate sector, due to its heavy reliance on financing to implement its projects, along with a recovery in demand amid the decline in the cost of real estate financing.

- In addition to technology companies and emerging industries, they will be among the most prominent beneficiaries of the interest rate cut, given their reliance on financing as a primary tool for expansion.

- Conversely, the banking sector may face pressure on profit margins due to the decline in interest rates on loans, coupled with lower profits.